<< Hide Menu

6.6 Real Interest Rates and International Capital Flows

4 min read•june 18, 2024

VladimirGenkovski

VladimirGenkovski

Real Interest Rates and Asset Value

Impacts on the loanable funds market

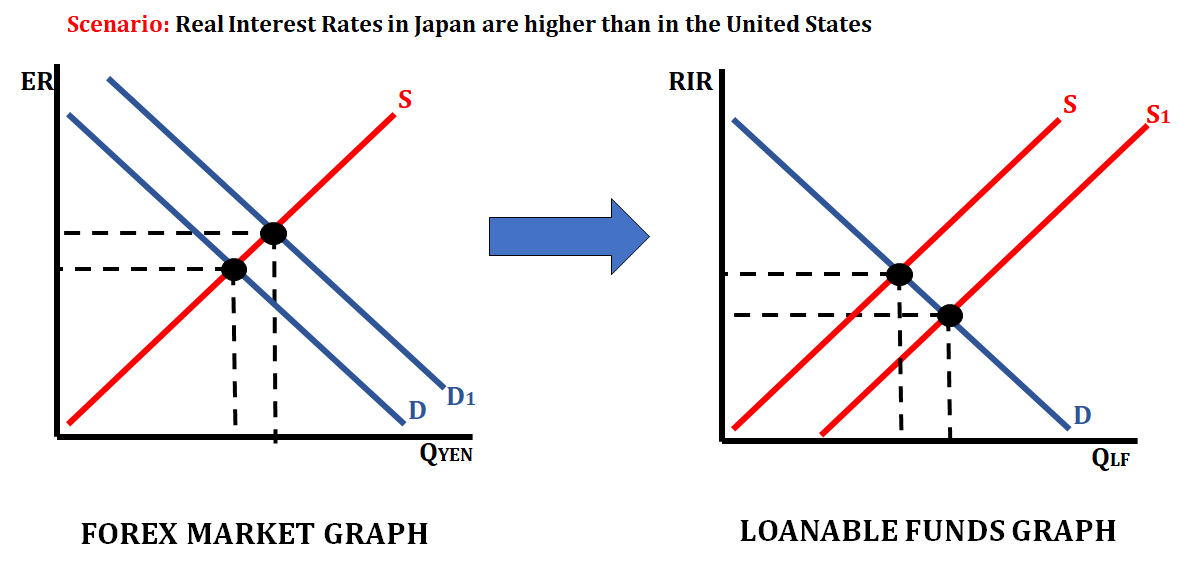

Differences in real interest rates across countries can affect the relative values of domestic and foreign assets in a few ways. First, a higher real interest rate in one country compared to another will make assets denominated in the currency of the country with the higher interest rate more attractive to investors, leading to an appreciation of that currency. This can make domestic assets more valuable relative to foreign assets for residents of the country with the higher interest rate, and foreign assets more valuable relative to domestic assets for residents of the country with the lower interest rate. Additionally, differences in real interest rates can also affect the relative values of domestic and foreign assets through their impact on capital flows, as investors may shift their investments to take advantage of the higher returns available in the country with the higher interest rate.

Capital flow is the movement of money for the purpose of investment, trade or business production. There are two types of capital flow: (1) inbound capital flow and (2) outbound capital flow.

Inbound capital flow is the injection of funds into a domestic economy that occurs through the purchase of domestic assets by foreign investors. An example would be a Japanese investor purchasing assets in the United States because they have a higher interest rate compared to similar assets in Japan. These domestic assets include stocks, bonds, or any other interest-bearing accounts. When real interest rates are high, it generates inbound capital flow. This is due to the fact that foreign investors look to invest their money into assets that have high-interest rates because they can earn a higher profit.

Outbound capital flow is the extraction of funds from a domestic economy that occurs through the purchase of foreign assets by domestic investors. An example of this is an American buying asset in Germany because they are yielding a higher interest rate, and they can earn more by doing this. Just like with inbound capital flow, these assets can include stocks, bonds, or any other interest-bearing accounts. When real interest rates fall, it generates outbound capital flow. This is due to the fact that domestic investors look to invest in other countries because the interest rate is higher there than in their own country.

The inflow or outflow of capital affects foreign exchange markets as well as the loanable funds market. Let's look at this effect in a graphical representation. In this particular situation, since interest rates are higher in Japan than they are in the United States, there is an increase in the number of Americans that are looking to invest in Japanese interest-bearing assets. When they do this, they will increase the demand for the Yen because they will need to exchange their dollars for the Yen. As a result, this will increase the amount of money that is available in loanable funds in Japan.

Notice how the self-corrective forces of supply and demand are exemplified in this situation.

Impacts on net exports

A higher real interest rate in one country compared to another will make the currency of the country with the higher interest rate more attractive to foreign investors, leading to an appreciation of that currency. This can make exports from the country with the higher interest rate more expensive for foreign buyers, and imports to that country cheaper, which can lead to a decrease in net exports.

On the other hand, a lower real interest rate in one country compared to another will make the currency of the country with the lower interest rate less attractive to foreign investors, leading to a depreciation of that currency. This can make exports from the country with the lower interest rate cheaper for foreign buyers, and imports to that country more expensive, which can lead to an increase in net exports.

Central Banks and Domestic Interest Rates

How can banks affect domestic interest rates? One way that banks can change domestic interest rates is by adjusting the interest rates they charge on loans. When banks raise the interest rates they charge on loans, it can lead to higher borrowing costs for businesses and consumers, which can, in turn, lead to higher interest rates across the economy.

Another way that banks can change domestic interest rates is by adjusting the interest rates they pay on deposits. When banks raise the interest rates they pay on deposits, it can lead to higher returns for savers, which can encourage them to save more and spend less, which can also lead to higher interest rates across the economy.

Central Banks also play a major role in determining domestic interest rates. Central banks use monetary policy tools such as open market operations, discount rates and reserve requirements to influence interest rates. When the central bank raises the interest rate, it will encourage banks to raise their own interest rates as well.

How do changes in domestic interest rates affect net capital inflows? Changes in domestic interest rates can affect net capital inflows by making a country's assets more or less attractive to foreign investors. If domestic interest rates are high, foreign investors may be more likely to invest in the country's bonds and other fixed-income securities, resulting in net capital inflows. Conversely, if domestic interest rates are low, foreign investors may be less likely to invest in the country's assets, resulting in net capital outflows. Additionally, a country with a high-interest rate can also appreciate its currency, making exports less attractive and imports cheaper, which can also reduce net capital inflows.

© 2024 Fiveable Inc. All rights reserved.